Guild Mortgage’s Michigan Home loan Recognition Processes

Whether you are an initial-Big date Family Buyer otherwise knowledgeable buyer, the borrowed funds recognition techniques can be a somewhat overwhelming thrill in place of an actual path map and you can an excellent party in your corner.

With the Michigan Guild Mortgage Group at the helm of your techniques, we are going to ensure that your home loan recognition techniques can be smooth that one may that will be used according to all of our commitment to transparency. We are going to familiarize yourself with you and your goals, discover what’s important to you personally, and you can fit you towards correct unit.

To be since the transparent as you are able to, we manage wish encourage our very own subscribers with a standard facts from what to anticipate. If you find yourself much of this is certainly communicated if you’re we’re working together, the next data is designed to provide a-frame out of reference having extremely important concepts and you can milestones about home loan processes.

Current system guidance, home loan rates issues, and you will advance payment criteria are a couple of the ingredients possible must be conscious of when providing home loan investment to have an excellent buy otherwise refinance.

Although this website is stuffed with helpful tips, industry words and you may calculators to help you research the financial approval techniques in more detail, this webpage was created to make you an intensive story of your own key elements working in bringing eligible for yet another mortgage.

Financial Recognition Areas:

Mortgage lenders accept borrowers for a loan, that’s covered by the a house, centered on a basic band of direction which might be basically determined of the brand of mortgage system.

Debt-To-Earnings (DTI) Proportion

The low this new DTI proportion a borrower possess (more cash regarding month-to-month borrowing from the bank costs), the greater number of convinced the lending company is mostly about getting repaid promptly subsequently in line with the financing terms and conditions.

Loan-to-Worthy of (LTV)

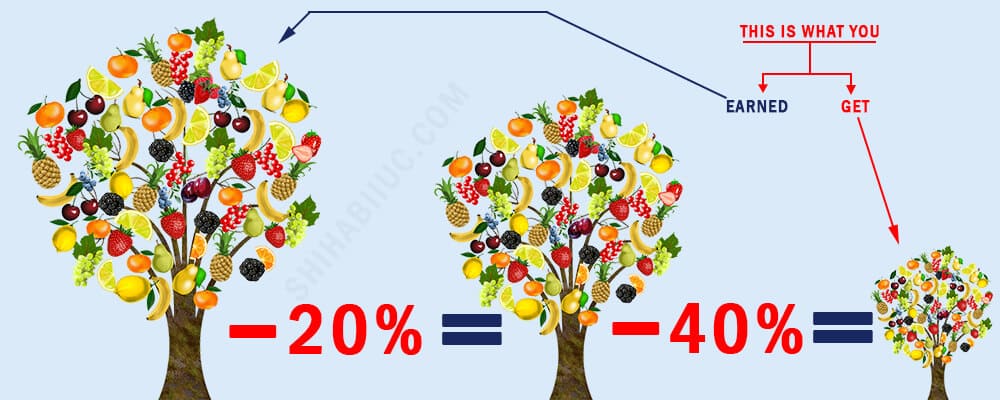

Loan-to-Really worth, or LTV, try a term lenders explore when comparing the difference between brand new a fantastic loan amount and you can good property’s worth.

Particular financing applications want a debtor to pay a bigger off percentage to cease financial insurance coverage, even though some regulators mortgage apps were created to simply help buyers safer funding to the property with 96.5% to 100% LTV Percentages.

EX: A conventional Financing necessitates the borrower to shop for mortgage insurance rates when this new LTV try higher than 80%. To prevent paying mortgage insurance rates, the fresh debtor will have to place 20% upon the purchase off another type of possessions. On good $100,000 purchase price, 20% down would equivalent $20,000.

Borrowing

Fico scores and history are utilized because of the lenders as the a hack to determine the projected risk for the a borrower.

When you’re lenders want to see several discover personal lines of credit that have a minimum of 2 years revealing background, some loan apps allow consumers to utilize option types of borrowing to qualify for a loan.

Possessions Brands

The type of assets, and exactly how you intend to the occupying the brand new residence, performs a primary character in the securing mortgage financing.

Due to certain HOA limits, government credit mortgage insurance criteria and you will assessment formula, it is important that their real estate agent understands the details and you may limitations of your pre-recognition letter ahead of place one also offers into the properties.

Financial Applications

Regardless if you are trying to find 100% financial support, low down percentage choices or need certainly to roll the expenses of upgrades into the a rehab mortgage, for each mortgage system possesses its own qualifying direction.

You will find authorities-covered mortgage apps, particularly FHA, USDA and Virtual assistant home loans, and additionally old-fashioned and you can jumbo financing.

A home loan elite will require under consideration your own personal LTV, DTI, Credit and you can Assets Types of scenario to determine and therefore financing system ideal suits you and needs.

The importance of Pre-Approval

In today’s Michigan a property pant, walking when you look at the in place of an excellent pre-approval letter feels as though turning up that have a knife within a great gun-strive. You can earn, however, might better promise lady chance is found on your own front side!

Most other home loan companies will get point your a beneficial pre-qualification https://cashadvancecompass.com/loans/short-term/ page that’s quick and simple to track down but is nowhere close just like the depend on-inspiring from the suppliers standpoint given that good Pre-Acceptance letter. In the Guild Financial, i front side-weight the job to give an educated probability of winning your bid, rather than leaving one thing up for grabs.

I do all the brand new economic due diligence in advance, also money verification, investigation from financial obligation weight, and credit history review and you can verification. If we say you happen to be Pre-Accepted, you’re Most pre-accepted. How about we almost every other loan providers do it much legwork on side prevent? Do not see, but a pre-certification page some loan providers generate have a tendency to isn’t worth the papers its composed toward when it comes time to close. In comparison, the PreApproval system assures a no-unexpected situations closure on your own dream house.

- I modify possessions-particular emails Punctual so all your possible vendors see ‘s the count you might be giving. Consider it. When they look for a high acceptance count toward an universal pre-approval letter, tend to they necessarily accept the render, or indication straight back to get more?

- We offer the Complete commission detail in getting the family on which you will be making the deal so you see exactly what can be expected with respect to money and you will settlement costs.

- We are able to help you strategically determine your best bring. In some cases, it makes sense to include provider concessions, for which the seller pays for doing 6% of the settlement costs.