The final 12 months have experienced lots of transform and you may they falls towards the you as the home loans to help you adapt to brand new brand new land. We indeed did not suppose that occasionally, industrial fund create getting less expensive than residential financial support funds!

APRA isn’t really attempting to make lifetime difficult

Because you’re probably aware, all banking companies made transform on the attract just policy and you can rates due to limitations put in place by the APRA. Because home loans, we obviously hate that have our very own solutions limited, otherwise people added complexity to deciding on http://clickcashadvance.com/personal-loans-ut/cleveland the best financing getting an excellent buyer.

- Australia is hooked on appeal simply fund, this can be a danger for both the banking companies and our homes markets.

- Partners borrowers know just how much much more interest they will shell out with an interest merely loan.

- There are many people while making attract only payments regardless of if its completely not the right in their eyes.

High questions result in high pointers

Home Financing Benefits weuse several simple concerns to decide if attention simply money was right for a client. Including, you could ask your people additionally crucial that you them:

- A diminished rate or down costs?

- Large borrowing from the bank stamina or a reduced rates?

- Do you wish to lower your money temporarily?

In the event that less price or a high borrowing from the bank strength is more crucial that you a buyers, then they really should become expenses P&I.

Holder occupied financing that have interest only costs

As a general rule, this is certainly an unacceptable option for most website subscribers and you’ll just consider this if there is a very good reason to take action.

Including, yourself Loan Experts we’d envision interest just for a house loan whether your buyer necessary payment independency with their business cash-move, or if perhaps it wanted to remain their money towards the standby during the an offset membership in the eventuality of issues, or if perhaps they wished to dedicate the a lot of fund.

If they’re perhaps not economically expert then it is harmful. These are generally unlikely to profit out-of attract simply costs and you can probably, they could not pay their house mortgage after all.

It is time to communicate with low-conforming lenders

In the home Financing Advantages, we believe money funds to-be a form of low-compliant mortgage. That’s not to state that banking institutions don’t perform her or him. They have been simply not new season of times while you would like to consider specialist lenders along with major of these whenever you are browsing meet the needs in your home trader readers.

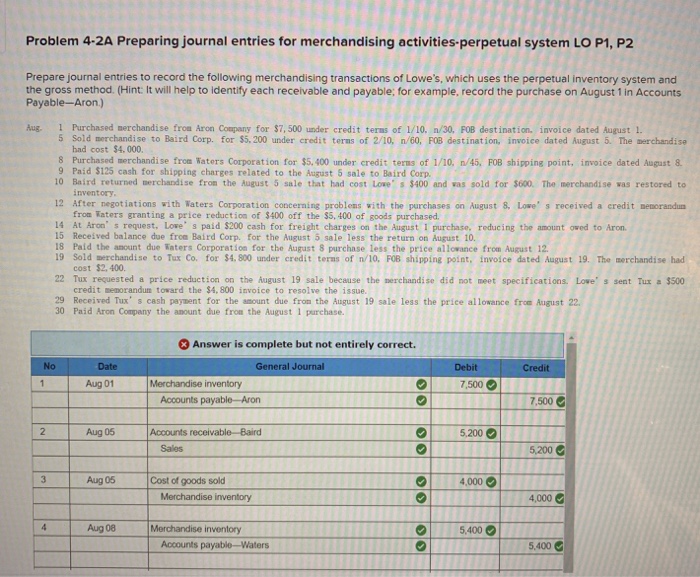

Precisely what do the brand new wide variety state?

Imagine if one of the consumers are deciding anywhere between a good $500,100000 resource loan in the 4.5% more than 3 decades, or a loan on 5% for five age which have desire only payments reverting in order to twenty five years in the 4.5% with P&We costs.

First of all the latest costs is $dos,533 / day P&I compared to $dos,083 / times notice merely. So that the payments are 21% highest if they shell out P&I. After the interest just months the fresh new payments would end up being $dos,779 that is nine% more than the high quality P&I costs over thirty years. Partners customers are familiar with this plus less take into account the perception that gets on the bucks-flow.

Using P&I, the consumer tends to make complete payments out of $912,034 whereas, which have a beneficial 5 year desire just period they’d spend $958,749. That’s a whopping $46,715 during the most interest! Again pair customers are aware of exactly how much far more it will cost them.

An excellent guideline is the fact a good 5 seasons desire simply months will definitely cost a buyers eleven% more inside desire along side label. Which is while, of course, that they don’t get various other interest just period when its earliest one to expires.

Think about borrowing from the bank power? When the an individual debtor that have a living regarding $one hundred,000 takes out home financing, they can obtain doing $620,100000 which have P&We costs or $585,100 with good 5 season focus just months. It is really not a large deal, simply a beneficial six% differences. Getting customers having multiple functions, it can expect to have large perception.

What about your current consumers?

Should you refinance them to the cheapest desire only mortgage readily available if they’re disappointed the help of its bank? Probably not. Variable prices will likely be changed at any time, very what is actually to cease the fresh new financial putting its prices upwards?

That means it is time to spend P&We. Correspond with these types of subscribers throughout the often switching to a great P&We financing, refinancing to another bank that have P&I costs, or if perhaps they do need to spend notice simply, then fixing its price tends to be sensible.

From the Otto Dargan

Otto is the Controlling Director off Home loan Experts and it has already been a member of Connective for over ten years. Financial Masters keeps claimed Significant Brokerage of the year (Non-Franchise) and you may Otto has double been called Australia’s Brightest Agent about Adviser’s Agent IQ Battle.