You may have seen a brochure getting medical fund into the reception dining table at the healthcare provider’s workplace or dental medical center. These types of loans are accustomed to funds scientific expenditures. They frequently provides low interest and you can words one lead to reasonable payments. Also, the applying procedure is the same for all, no matter whether you’ve got a disability.

The fresh new hook is the fact most medical money try deferred-attract loans. If you don’t pay back the complete loan towards the end of your own advertisements period, you will be charged focus from the beginning big date of the mortgage, such as the part you may have currently paid back.

For people who discover federal disability professionals, you happen to be eligible for both Medicaid, Medicare, or each other. In a few states, you could demand publicity backdated to 3 months just before their software having publicity. These may be better alternatives for that explore in advance of your apply for a health mortgage.

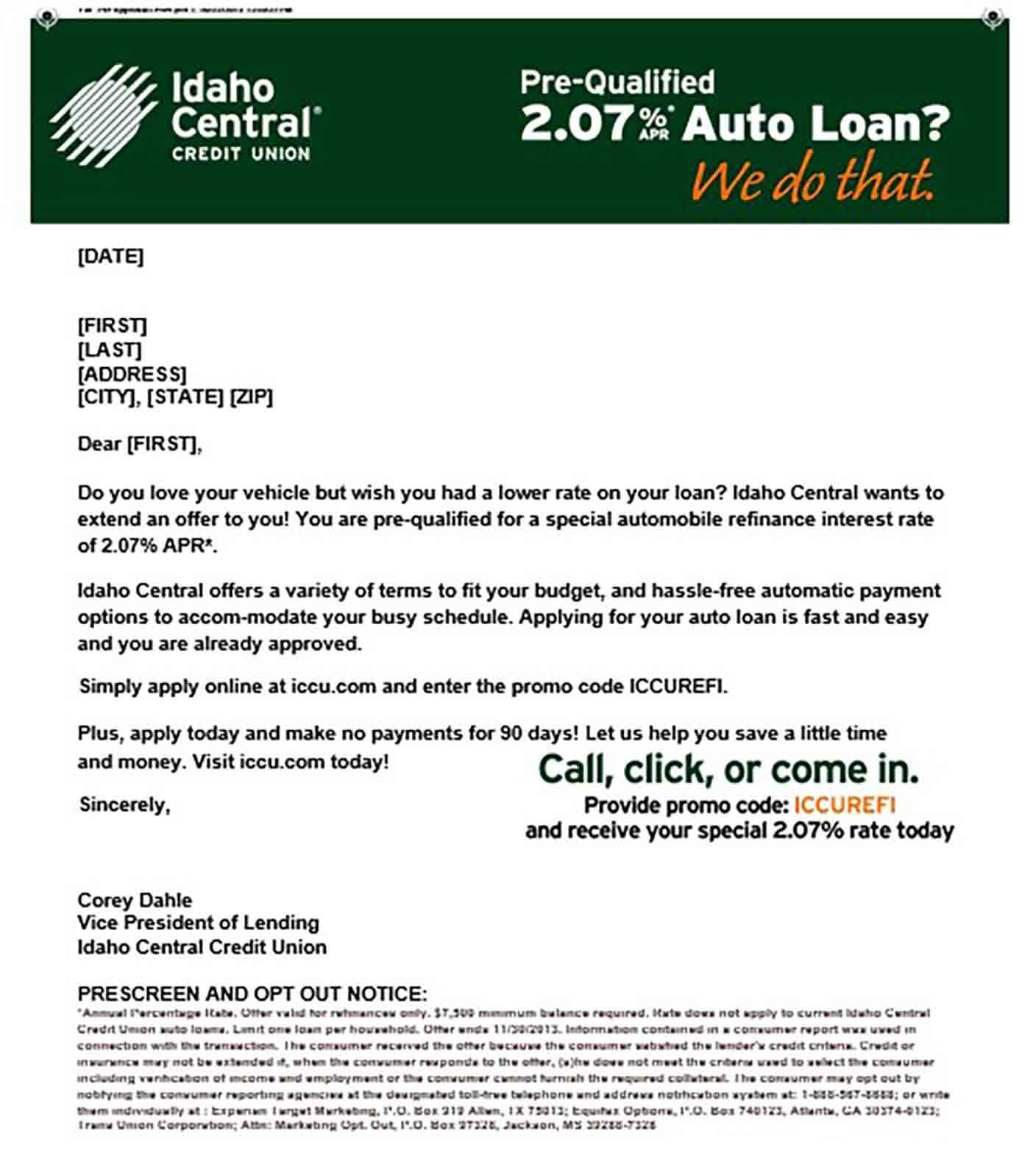

Car loan

An auto loan is a protected financing that utilizes your vehicle as equity. If you standard, the financial institution may take aside the brand new guarantee.

You could sign up for a car loan during impairment rather than jumping as a consequence of one special hoops. Really car loan lenders has the very least credit history criteria and you can only work on a credit check to find out if you qualify. Some may also verify your earnings.

Pay day loan

Most people are incapable of repay the payday loans completely of the deadline. If in case that takes place, you will need to renew the borrowed funds and you may spend much more charge. If you possibly could, it’s a good idea to obtain selection so you can payday loan prior to grabbing what ends up a simple, easy financing.

- Check your borrowing: Ensure your credit score doesn’t have any mistakes which will apply to what you can do in order to qualify for that loan.

- Ask for assist: Check with your local Agencies of Health and Peoples Qualities workplace to find out if you are eligible for financial help.

- Research unique software: Special loan apps might help anybody into the a small fixed-income get the financing they require.

- Look around for the best cost: Evaluate costs that have multiple loan providers, specifically those who’ll carry out a soft pull on their credit unless you will be ready to use.

- Wait until you prefer the mortgage: Prevent obtaining the loan too quickly, or you could threaten the handicap income.

- Get the mortgage: Your own lender will say to you exactly what files to submit.

Like any major economic decision, you will need to weigh the advantages and you can cons off taking out a consumer loan, particularly when you are on a fixed earnings. Your best option is always to take time to know the options and you can meticulously decide which works for you.

The newest Ascent’s finest signature loans

Shopping for a personal bank loan but do not know how to start Trumbull Center loans? Our favorites offer brief recognition and you may stone-base rates of interest. Here are a few all of our number for the best loan to you personally.

Yes. For folks who qualify, you can purchase a consumer loan while on handicap. Anticipate the lender to evaluate your own borrowing from the bank. You might have to have the absolute minimum credit rating or a good limit loans-to-earnings ratio, and your financial should probably look for proof of their money.

More often than not, yes. Long-name disability masters and long lasting impairment insurance rates matter once the earnings getting the objective of qualifying for a loan.

It is preferable to talk to lenders and you can bodies businesses from the unique applications that might create simpler for you so you can ensure you get your economic requires found. After you identify ideal system, making an application for that loan with the impairment is not any distinctive from using less than most other facts. Before applying, make sure that your credit file was mistake 100 % free, pay-all of your expense timely, and you may reduce their almost every other obligations around you can.