If you find yourself purchasing a home when notice-employed, you will likely enjoys a difficult way to providing a mortgage than some body having traditional a career. The mortgage lender requires most records, generally to assist establish your work and you may income is stable and legitimate. Fortunately? With a little thought and you may preparing, you can purchase towards the that new home.

The good Resignation plus the mind-a position trend

The COVID-19 pandemic has had a strong affect a position on the United states. Compelling what is actually started called The nice Resignation, the pandemic might have been a stimulant having number variety of some body to go out of secure services. Specific decided to search for a brand new come from new marketplaces, even though some are retiring or delivering a break regarding strive to manage their families or any other duties.

However others provides soared to the entrepreneurship. According to Agency away from Work Statistics, what amount of unincorporated self-working gurus rose by the 622,100 anywhere between ericans today pick as the self-operating anybody.

What to expect while you are mind-operating and trying to get home financing

When you’re thinking-functioning – you may be a just holder, an excellent 1099 builder, or if you own 25% or higher out of an enthusiastic LLC or agency – and you are clearly looking for a unique family, everbody knows you deal with some extra difficulties for the the borrowed http://www.elitecashadvance.com/personal-loans-ms/bolton funds application processes. Fact is, mortgage brokers imagine self-operating borrowers as more difficult to have a look at and you may underwrite than those having antique a job.

From the a high level, lenders find an equivalent one thing from a prospective notice-working borrower as other mortgage applicant. They would like to select a robust credit rating, which implies a responsible entry to credit and you can a reputation repaying bills. It look at personal debt-to-money ratio (DTI) to be sure the debtor are able a home loan percentage and you may isn’t overloaded in other expenditures. Plus they see liquids offers and you can property so that the debtor provides enough currency to manage the brand new financial obligations that can come that have homeownership. All of these circumstances are based on brand new borrower’s personal monetary condition – perhaps not the organization funds.

What records is needed to help the home loan app?

The borrowed funds financial most likely in addition to desires an effective verifiable history of in the the very least two years from thinking-a position, including confirmation of taxable care about-employment money in those days. Although a borrower uses paystubs and you may things W2 salary statements at the conclusion of on a yearly basis, the lending company probably requires extra documentation to ensure money. This could tend to be some of the adopting the:

- Couple of years away from individual and (in the event the relevant) organization tax statements

- W2 comments and you can paystubs, in case the borrower spends him or her inside their providers payroll

- A duplicate out-of county otherwise providers permit

- A letter off a professional business inside a related industry attesting in order to registration and you may organization sense

- A finalized letter out of an official societal accountant (CPA) claiming many years running a business

- Finalized characters regarding website subscribers

- Present organization receipts or statements showing evidence of company process

- An income and you can loss report, perhaps audited of the an effective CPA

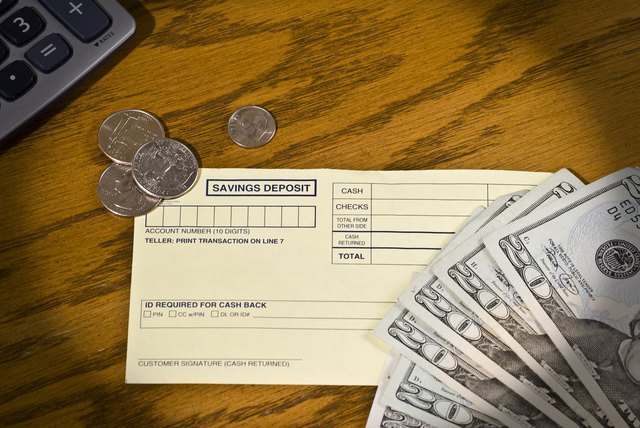

- Bank statements you to ensure the total amount inside personal discounts; this type of is to inform you capacity to make an advance payment while you are nonetheless having cash in put aside

- A starting Business As (DBA) issued no less than 2 years in the past

A mortgage lender could possibly get deal with lower than two years of care about-work background if for example the borrower also can offer files for earlier antique a position. In this situation, however, the financial institution could possibly get consult files about knowledge and you will education since it identifies the newest borrower’s industry.

Ideas on how to package in the future to try to get a mortgage loan when self-functioning

One family visitors have to do their homework before applying having a beneficial home loan. This is especially true to possess a personal-employed borrower. Ahead of aiming in your homebuying journey, make sure that you might be arranged while making a confident perception to help you loan providers.